The US Cryptocurrency Report: A Comprehensive Analysis

In the ever-evolving landscape of digital assets, cryptocurrencies have emerged as a significant player, capturing the attention of investors, regulators, and the general public alike. The United States, with its robust financial system and technological prowess, has become a focal point for this burgeoning industry. This report delves into the current state of cryptocurrencies in the U.S., exploring their impact on the economy, regulatory environment, and societal implications.

Market Dynamics

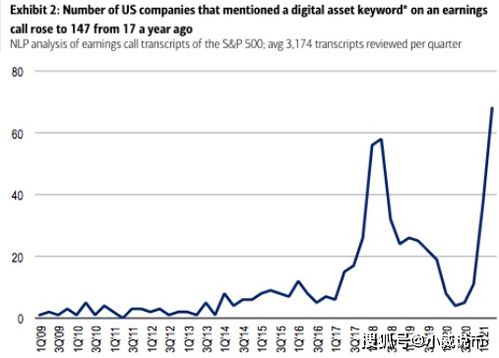

The cryptocurrency market has seen unprecedented growth in recent years, driven by a combination of factors including technological advancements, regulatory developments, and a growing acceptance of digital assets. The total market capitalization of cryptocurrencies has soared, reaching several trillion dollars, and this figure continues to rise steadily. Bitcoin, the most well-known cryptocurrency, remains the largest player, but other altcoins like Ethereum, Binance Coin, and Solana are also gaining traction.

Regulatory Environment

The regulatory landscape for cryptocurrencies in the U.S. is complex and evolving. Regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have taken significant steps to address the unique risks associated with digital assets. In 2021, the SEC issued several key decisions regarding initial coin offerings (ICOs) and cryptocurrency trading, emphasizing the need for greater transparency and compliance.

Economic Impact

Cryptocurrencies have had a profound impact on the U.S. economy. They have facilitated cross-border payments, reduced transaction costs, and provided a new asset class for investment. However, they have also led to concerns about money laundering, fraud, and other illicit activities. The financial stability implications of cryptocurrencies are still being closely monitored by regulators.

Societal Implications

The rise of cryptocurrencies has sparked a wide range of discussions about the future of money, technology, and society. Proponents argue that cryptocurrencies offer a more secure, transparent, and decentralized alternative to traditional financial systems. Critics, however, raise concerns about the potential for market manipulation, the lack of regulatory oversight, and the environmental impact of blockchain technology, particularly for energy-intensive mining operations.

Future Outlook

Looking ahead, the future of cryptocurrencies in the U.S. is likely to be shaped by several key trends. Regulatory frameworks will continue to evolve to address emerging challenges, while technological advancements will drive innovation within the industry. The integration of cryptocurrencies into the broader financial ecosystem is likely to accelerate, with more institutions and businesses adopting digital assets.

Conclusion

The U.S. cryptocurrency market is at a pivotal moment, with significant opportunities and challenges ahead. As the industry continues to grow and evolve, it will be crucial for regulators, businesses, and consumers to work together to create a regulatory environment that supports innovation while ensuring the stability and security of the financial system. The story of cryptocurrencies in the U.S. is still being written, and it will be interesting to see how it unfolds in the coming years.