Introduction to Bitcoin Halving: What It Means and Its Impact

Bitcoin, the world's first decentralized cryptocurrency, has been a topic of interest for investors, enthusiasts, and technologists alike. One of the most anticipated events in the Bitcoin ecosystem is the halving. This article delves into what Bitcoin halving is, its significance, and the potential impact it may have on the market.

What is Bitcoin Halving?

Bitcoin halving is an event that occurs approximately every four years, where the reward for mining a new block is halved. This event is hardcoded into the Bitcoin protocol and is a fundamental aspect of its deflationary nature. Initially, miners were rewarded with 50 BTC for every block they successfully mine. With each halving, the reward is cut in half.

How Does Bitcoin Halving Work?

The Bitcoin halving process is automated and does not require any intervention from the developers or the community. The reward for mining a block is determined by the protocol, and when the total number of bitcoins in circulation reaches 21 million, the reward will be reduced to zero. This means that the halving event is a gradual process, with the reward being halved every 210,000 blocks, or approximately every four years.

Significance of Bitcoin Halving

Bitcoin halving is significant for several reasons. Firstly, it is a key factor in the deflationary nature of Bitcoin. As the supply of new bitcoins is reduced over time, the value of existing bitcoins may increase, assuming demand remains constant. This has been a driving force behind the price appreciation of Bitcoin in the past.

Secondly, Bitcoin halving creates a predictable and transparent timeline for the supply of new bitcoins. This can help investors and miners plan their strategies accordingly. The upcoming halving event, scheduled for April 2024, is a prime example of this predictability.

Impact of Bitcoin Halving on the Market

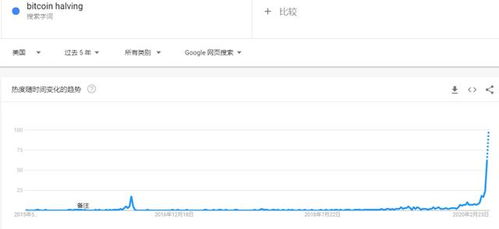

Historically, Bitcoin halving events have been associated with significant price movements in the cryptocurrency market. The first halving occurred in 2012, and Bitcoin's price surged from around $13 to over $1,100 within a year. The second halving took place in 2016, and Bitcoin's price experienced a similar upward trend, reaching over $20,000 by the end of 2017.

While the impact of Bitcoin halving on the market is not guaranteed, there are several factors that could contribute to a positive outcome. These include increased interest from institutional investors, a growing adoption rate, and the potential for Bitcoin to become a more widely accepted form of digital currency.

Challenges and Risks

Despite the potential benefits of Bitcoin halving, there are also challenges and risks to consider. The cryptocurrency market is highly volatile, and Bitcoin halving events can lead to significant price fluctuations. Additionally, regulatory changes, technological advancements, and competition from other cryptocurrencies could impact Bitcoin's long-term prospects.

Conclusion

Bitcoin halving is a critical event in the cryptocurrency ecosystem, with the potential to influence the market in various ways. While the impact of halving events is not always predictable, they remain a significant aspect of Bitcoin's deflationary nature and its long-term value proposition. As the next halving approaches, investors and enthusiasts will be closely watching to see how the market responds.

Tags: